Employer payroll tax calculator

Get Started With ADP Payroll. Important note on the salary paycheck calculator.

Payroll Tax Calculator For Employers Gusto

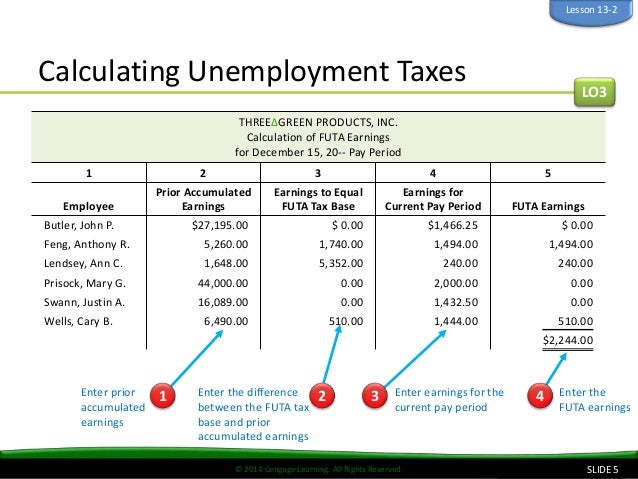

The standard FUTA tax rate is 6 so your max.

. To calculate Medicare withholding multiply your employees gross pay by the current Medicare tax rate 145. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare. Prepare your FICA taxes Medicare and Social Security monthly or semi-weekly depending on your.

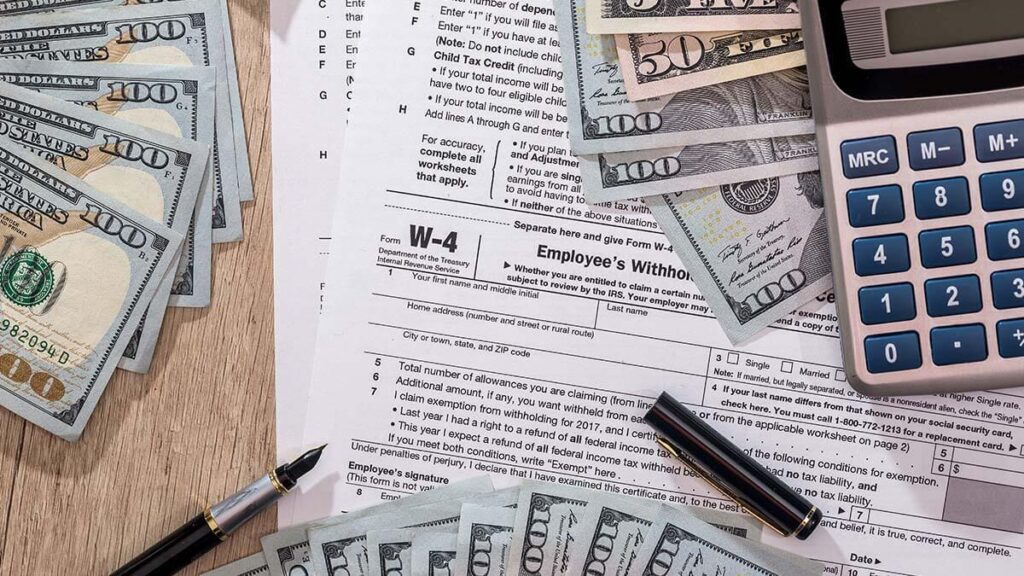

All Services Backed by Tax Guarantee. Enter the requested information from your employees Form W-4. Free Unbiased Reviews Top Picks.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. Ad Process Payroll Faster Easier With ADP Payroll. Print pay stub with detailed summary or.

Intelligent user-friendly solutions to the never-ending realm of what-if scenarios. Ad Compare This Years Top 5 Free Payroll Software. Payroll Tax Calculator Determine the right amount to deduct from each employees paycheck.

For employees who are paid an annual salary gross pay is calculated by dividing their annual salary by the number of pay periods in a year. Ad Payroll So Easy You Can Set It Up Run It Yourself. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

If youre a new employer youll pay a flat rate of 3525. Enter the payroll information into Incfiles easy Employer Payroll Tax Calculator. Make sure you are locally compliant with Papaya Global help.

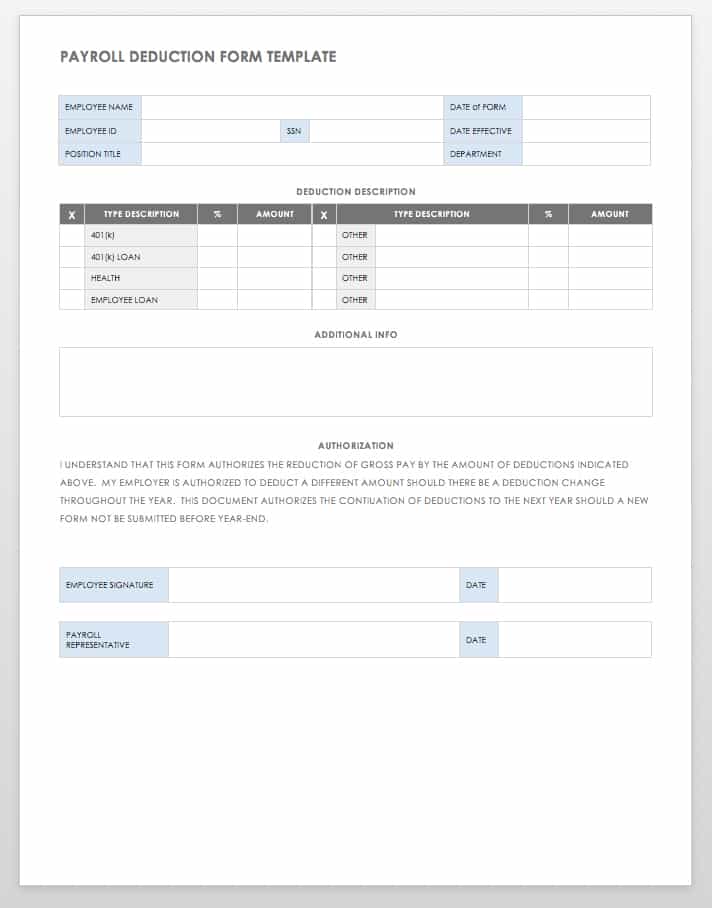

Free Unbiased Reviews Top Picks. Summarize deductions retirement savings required taxes and more. Important note on the salary paycheck calculator.

Global salary benchmark and benefit data. Discover ADP Payroll Benefits Insurance Time Talent HR More. Both employers and employees are responsible for payroll taxes.

Public employees exempt employees paycheck calculation. The calculator includes options for estimating Federal Social Security. For example you might instruct your employer to withhold 10 of your.

We calculate file and pay all federal state and local payroll taxes on your behalf. The wage base is 8000 for 2022 and rates range from 0725 to 7625. Our online service is available anywhere anytime and includes unlimited customer support.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Ad Compare This Years Top 5 Free Payroll Software. View FSA Calculator A.

Remember paying your SUI in full and on time. Discover ADP Payroll Benefits Insurance Time Talent HR More. Save a copy of the spreadsheet with the employees name in the file name.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Use the Free Paycheck Calculators for any gross-to-net calculation need. If you want a.

Add year-to-previous period information that ensures the calculation accuracy. Each pay period open each employees Tax. Your employer might also withhold money if youve instructed it to do so as part of your employee benefit enrollment.

Ad Process Payroll Faster Easier With ADP Payroll. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. For example if an employee earned an annual.

All Services Backed by Tax Guarantee. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. It only takes a few seconds to.

Example Medicare withholding calculation. Get Started With ADP Payroll. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Calculate payroll taxes Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Ad Payroll Employment Law for 160 Countries. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

15 Free Payroll Templates Smartsheet

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Taxes On Payroll Shop 57 Off Powerofdance Com

What Are Payroll Taxes Types Employer Obligations More

Payroll Tax What It Is How To Calculate It Bench Accounting

Salary Income Tax Calculation In Ethiopia Payroll Net Pay Pension Cost Sharing Calculator With Examples Addisbiz Com

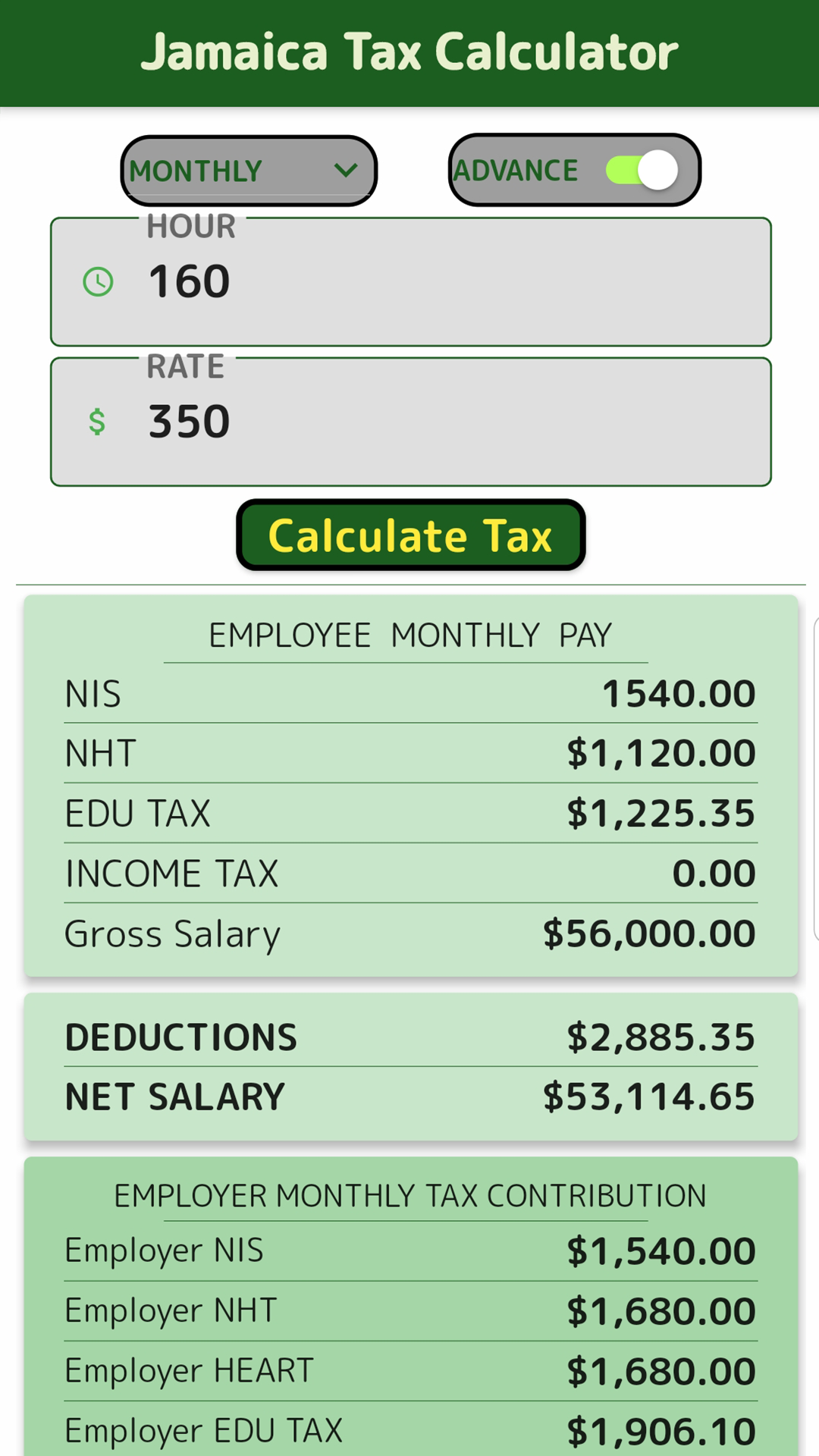

Jamaica Tax Calculator It S All Widgets

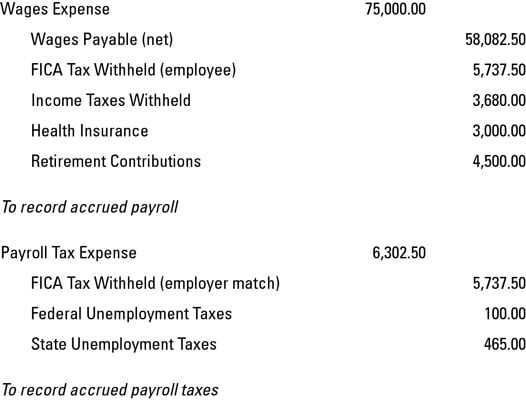

How To Record Accrued Payroll And Taxes Dummies

Calculation Of Federal Employment Taxes Payroll Services

Federal Income Tax Fit Payroll Tax Calculation Youtube

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Calculation Of Federal Employment Taxes Payroll Services

Employer Payroll Tax Liability Tax Deposits And Fraction Of Cents For Form 941 Paycheck Manager

Payroll Formula Step By Step Calculation With Examples

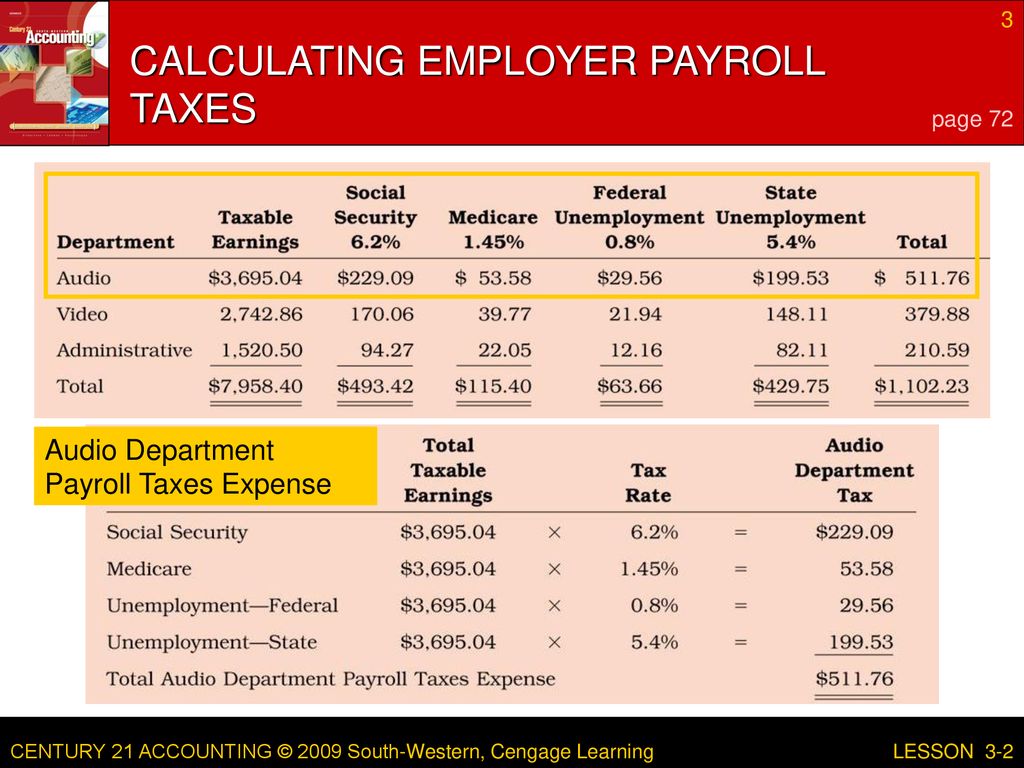

Lesson 3 2 Recording A Payroll And Payroll Taxes Ppt Download

Payroll Formula Step By Step Calculation With Examples